Insurance Perth

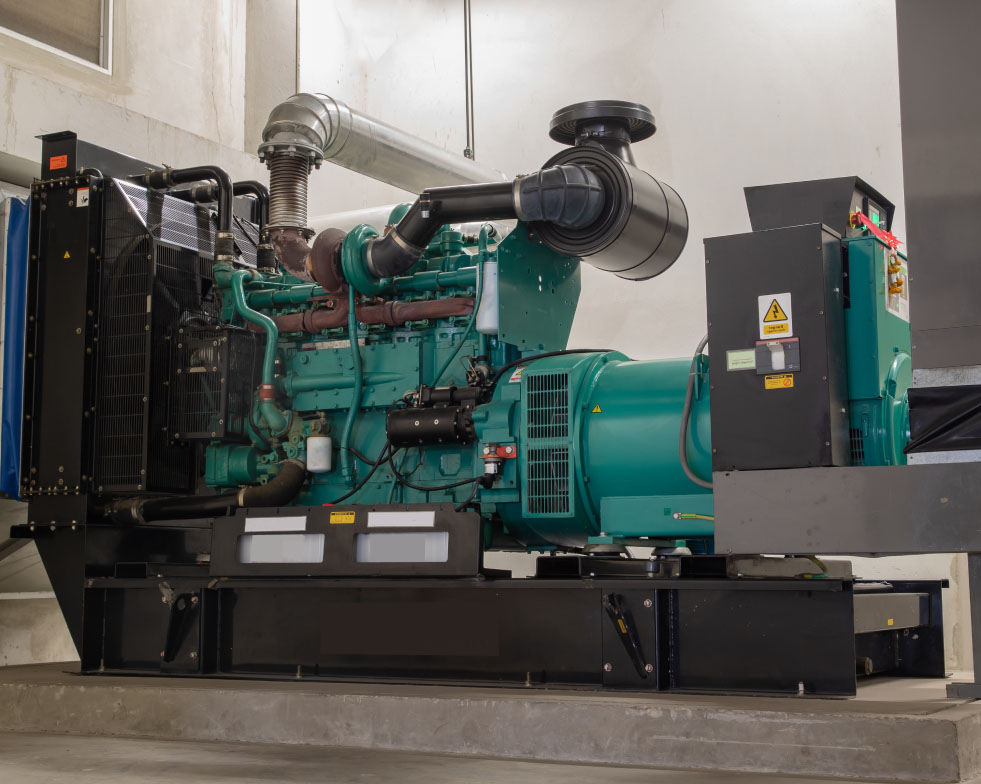

Whether your business operates in hospitality, manufacturing, mining, production, or retail, motors and machinery are crucial for maintaining smooth operations. A sudden motor failure or shutdown can severely disrupt your business. This is why it is vital to have robust insurance for machinery in place.

Due to the frequency of machinery breakdown claims, we typically recommend purchasing machinery insurance as a standalone policy. This approach ensures that any claims made will only affect this specific policy, minimising the impact on your overall insurance costs.

Key Features of

Machinery Breakdown

Insurance Coverage

The Cost of Machinery

Breakdown Insurance

The cost to have Machinery Breakdown insurance is very affordable. The premium depends on the number of motors you want to insure and the payout limit you require for claims.

Here’s a helpful tip when purchasing this coverage: first, choose an excess amount that you’re comfortable paying, such as $500 per claim. Then, identify the motors that would cost more to replace than your chosen excess and insure those. This approach allows you to focus on insuring only the machinery items that matter most, helping you avoid unnecessary expenses for smaller items that you may never claim on.

What Types of

Machinery are Covered?

- Air conditioning

- Cool room motors, fridges or freezers

- Boilers

- Pressure vessels

- Gaming Machines

- Pumps

- Some policies can also include cover for electrical breakdown

Today

Contact Matrix Insurance today on (08) 6555 7742 to speak with an insurance broker who can help you.